Deposit guarantee in the USA

The most important points first:

- Money on your checking or savings account at every US bank is guaranteed for an amount up to 250,000 USD

- In case of a bankruptcy of the bank, you can expect a 100 % refund of your money, up to the guaranteed amount of 250,000 USD and within a few days. Deposits beyond that limit are lost.

- In case of deposits in constantly higher amounts it is recommended to:

- divide the money onto several banks

- choose an especially secure bank.

Let’s get started …

The deposit guarantee system is supposed to protect bank customers from a loss of their deposits, in case their bank cannot pay the money back. Such deposit guarantee systems are being implemented in the USA as well as in Germany and other parts of the world.

Most banks only retain only part of their customer’s money in the form of cash. The rest is being reinvested/invested in long-term investment forms, so they can benefit from the higher interest rates associated with these.

But if all customers of a bank claimed their deposits back at the same time, it is possible that the bank cannot pay all of them back.

A deposit guarantee is supposed to prevent bank runs.

This of course does not happen usually. But if the public got the impression, that the deposits at a particular bank are not secure or that there might be a bankruptcy risk – as it can happen in an economic crisis – it is indeed possible, that a huge percentage of the customers of that bank try to withdraw their deposits from that bank as quickly as possible (“bank run”). This can then indeed cause the bankruptcy of a bank.

Historical background: The “Great Depression“

Such situations really did occur in the past, for example in the 1930ies during the severe economic crisis in the US (“Great Depression“), which brought along the downfall of many US banks.

One of the key reasons for that was the breakdown of the stock market, which caused the ruin of many stock market investors, who in turn were not able to pay back their bank loans.

Between 1929 and 1932 around 10,000 banks went bankrupt, and 13 millions of US-Americans lost their jobs during that time.

This “Great Depression” is known as the longest and most severe in the history of the USA. Between 1929 and 1933 bank customers lost 1.3 billion in deposits.

As a reaction to this crisis, then US-President Franklin D. Roosevelt implemented a division between investment and commercial banks (Glass-Steagall Act) and founded the „Federal Deposit Insurance Corporation” (FDIC).

The FDIC was furnished with an initial loan of 289 million USD and secured the bank deposits of account holders with a limit of 2,500 USD each.

As a result of the bankruptcy of the Fond Du Lac State Bank in East Peoria, Illinois, on July 5, 1934, the first payment of such an insurance sum was made to Mrs. Lydia Lobsiger.

The FDIC of the Present

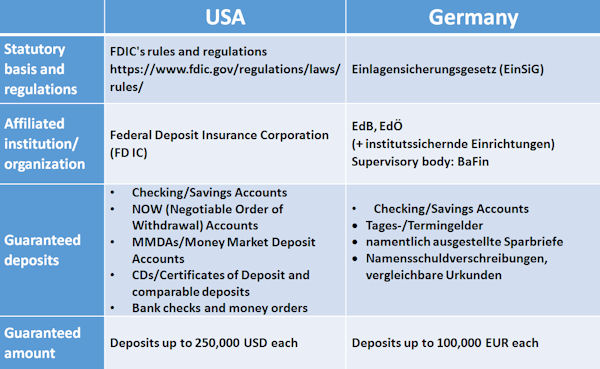

Currently, the FDIC secures the following kinds of deposits of each up to 250,000 USD:

- Checking and Savings Accounts

- NOW (Negotiable Order of Withdrawal) Accounts

- MMDAs/Money Market Deposit Accounts

- CDs/Certificates of Deposit and comparable deposits

- Bank checks and money orders

Not insured by the FDIC are:

- Annuities

- Mutual funds

- Stocks, bonds

- Government and municipal securities

- U.S. Treasury securities

During the time of its existence, the FDIC has already been crucially tested several times.

For example: 2008 the Washington Mutual bank became insolvent and was met by a bank run that lasted several days. In 2009 and 2010 together, almost 300 banks, whose customer deposits were insured by the FDIC, were affected from bank failure.

Customers of almost 300 banks have been compensated during the economy crisis 2009/2010

This did not happen at the expense of US tax payers, though, since the FDIC is not financed from tax money but from bank levies and investments in US government bonds.

When a bank faces bankruptcy, there is also the possible scenario that the bank is purchased and – for example – taken over by a bigger bank. If only a part of the bank is taken over or no buyer can be found, the FDIC steps in.

In the case of compensation, die FDIC is legally bound to make the respective payments „as soon as possible“. According to the FDIC, the goal is to carry out such payments within two business days of the insolvency of an insured bank.

For comparison: the deposit guarantee in Germany

In Germany, the deposit guarantee is mandated by law but is also being taken care of on a voluntary basis.

Legal basis for this has initially been – starting 1998 – the „Einlagensicherungs- und Anlegerentschädigungsgesetz“. On July 3, 2015, all references to a deposit guarantee („Einlagensicherung“) were deleted and the law renamed to „Anlegerentschädigungsgesetz“ (AnlEntG). On the same day, the „Einlagensicherungsgesetz“ (EinSiG) became effective and has been regulating the deposit guarantee since then.

According to this law, the affiliation with one of the organizations for deposit guarantees is a prerequisite for a credit institution/bank (apart from the Sparkassen / savings banks , Genossenschaftsbanken / cooperative banks and Landesbanken / state banks as well as Landesbausparkassen / state buildings and loan associations) in order to be permitted for business.

The financial institutions are assigned to a statutory compensation institution depending on their category:

- Private Banks / Home savings and loan associations – Entschädigungseinrichtung deutscher Banken GmbH (EdB)

- Public Banks – Entschädigungseinrichtung des Bundesverbandes Öffentlicher Banken Deutschlands GmbH (EdÖ)

- Stock broking banks, financial service providers, capital investment companies – Entschädigungseinrichtung der Wertpapierhandelsunternehmen (EdW)

Sparkassen / savings banks, Genossenschaftsbanken / cooperative banks as well as Landesbanken/state banks and Landesbausparkassen/state buildings and loan associations are affiliated with so called “Institutssichernde Einrichtungen” (i.e. organization for the protection of institutions.)

The supervisory body for the statutory as well as for the “institutssichernde” organizations the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin – i.e. Federal Supervisory Institution for Financial Services).

Through the statutory deposit guarantee, the deposits of private bank customers (though not those of institutional investors, e.g. other banks) are secured in the amount of up to 100,000 EUR each, in case the respective bank is not able to pay back the deposits.

USD accounts are not protected by the German deposit guarantee (neither in Germany nor elsewhere in Europe!

Deposits in other European currencies are protected as well, though not CHF and USD.

Guaranteed deposits include:

- Balances on checking and savings accounts

- Day-to-day-money / time deposits

- savings certificates issued by name

- Registered bonds and comparable certificates

Not guaranteed by the statutory deposit guarantee (since they are not considered deposits) are:

- Bearer bonds/bonds made out to order

- Profit participation certificates

- Liabilities from own bills of exchange

- Securities, stocks

Voluntary deposit guarantee

Beyond the statutory deposit guarantee, many financial institutions in Germany have implemented additional voluntary securing measures in order to provide security even beyond the statutory scope.

- Private banks – Einlagensicherungsfonds des Bundesverbandes deutscher Banken e.V. (BdB)

- Public banks – Einlagendsicherungsfonds des Bundesverbandes Öffentlicher Banken Deutschlands (VÖB)

- Bausparkassen (home savings and loan associations): Bausparkassen-Einlagensicherungsfonds – Verband der Privaten Bausparkassen e.V.

Overview for you:

Leave a Reply